HydroGraph Clean Power (CAN: HG | US: HGCPF) Could Propel Major Materials Tech Revolution

You are at a turning point in history.

The colossal global materials industry is on the verge of its greatest innovation in decades.

It’s a lot like 1994 when a $1 trillion materials sector boom was just getting started.

That was the year Motorola released the MicroTac cell phone powered by a lithium-ion battery.

Lithium-ion was the smaller, lighter, and more powerful battery option.

It was going to win out over time.

And it has.

Lithium-ion batteries have been rapidly growing ever since.

Today Research And Markets estimates the global lithium battery market to reach $1 trillion by 2026.

Truly staggering growth. Zero to $1 trillion. And many fortunes made along the way.

Now you’re in the earliest stage of another potential world-altering materials revolution with just as much growth potential.

An advanced material has been developed that could unlock innovation potential across multiple industries just like lithium-ion did to energy, telecommunications, and autos.

The only difference it’s not a $100 billion+ industry – yet.

In fact, it’s just starting to hit the “sweet spot” of its growth trajectory.

And there’s one small, upstart company called HydroGraph Clean Power (CAN:HG / US:HGCPF) that has positioned itself to be a potential driving force in it all.

If you are looking for big potential growth, this story could be before you.

So let’s start at the beginning.

Smaller, Lighter, Stronger:

The “Wonder Material” Of The 21st Century

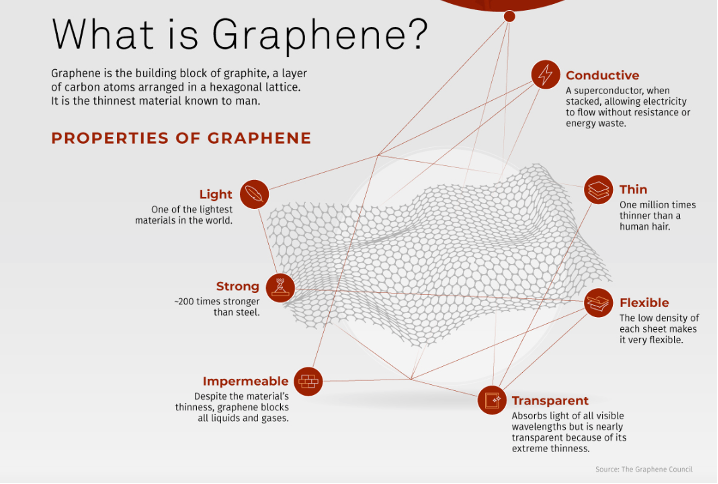

The starting point of all this is a material called graphene.

Graphene was first discovered in 2004 two chemists working at the University of Manchester in England.

Graphene is made up of a single sheet of carbon atoms arranged in a honeycomb format.

If you’ve heard of graphene, you know it has the potential to be a genuine modern miracle.

It just has so many outstanding properties.

Graphene is…

Lighter than paper…

100x stronger than steel…

Has greater capacity to transmit electrical current than copper.

No wonder the Guardian has called graphene a “wonder material.”

There are just so many inherent advantages of graphene.

As you should expect, with a story this good, there’s been no shortage of hype about its potential.

But here’s the thing.

It takes time to introduce new materials into supply chains.

Often years and years.

Take a look at lithium-ion batteries again.

They were first developed by researchers at Exxon in 1976.

But it wasn't until 1994 that Motorola rolled out its MicroTac phone with a lithium-ion battery and proved the reliability and superiority of lithium-ion.

That was 18 years.

Well, it’s been about the same time for graphene.

And, as you’ll see in a moment, graphene’s “Motorola Moment” could be here right now.

It’s all part of a well-trod and proven path all investors should be familiar with.

Tipping Point: Slowly, Then All At Once

Materials innovations form the foundation of the some of the history’s greatest fortunes.

You know of the steel and oil barons of a century ago.

However, a more precise comparison to the point graphene is today would be bauxite, the ore that is the core precursor to aluminum.

Aluminum is an essential metal to the modern world.

It’s light, strong, and highly economical in many applications.

Everything from affordable air travel to six-pack beer storage and distribution relies on aluminum.

But it wasn’t always that way.

Aluminum was first discovered in the early 1800s by Sir Humphry Davy.

It’s inherent low weight and strength made it a true “wonder material” of the time.

But there was a problem.

Aluminum production was absurdly expensive.

Emperor Napoleon III famously reserved his limited aluminum dining utensils for his most highly honoured guests.

Everyone else had to make do with gold.

That’s how unique and expensive aluminum was at the time.

Aluminum was going for $16 per pound at the time (more than $400 in today’s dollars).

But that all changed in 1886.

That year Charles Martin Hall, a chemist in Ohio, discovered a process of heating bauxite and adding chemical catalysts to produce aluminum.

It was a world-altering discovery.

And the founders of the production process went on to make fortunes from it.

Hall founded the Pittsburgh Reduction Company to produce aluminum.

You know that company today as Alcoa (AA), one of the largest aluminum companies in the world.

The key point here is that aluminum was always a vastly superior material over steel, iron, copper, and brass.

But it wasn’t until the production process was advanced enough to drive down the price of aluminum that it became widely adopted.

That’s what’s happening with graphene due to HydroGraph’s (CAN:HG / US:HGCPF) advanced production process and technology, except unlike with aluminium, graphene can be added to virtually any material to improve its performance.

Hydrograph has a truly amazing process to produce high-quality graphene on a consistent and massive scale.

And it is doing it at a time when multiple industries could be rolling out real-world graphene applications.

But first, you should understand why graphene has so much potential and so many companies have been aggressively researching for years.

How Graphene Is Propelling Industries Of The Future

True graphene (the “true” is important here and you’ll see why below) is less than 10 layers of carbon atoms.

The bonds between the carbon atoms are so strong that graphene is 200x stronger than steel.

Great hopes have surrounded the transformative properties of graphene since its Nobel Prize winning discovery in 2004.

Graphene is a true wonder material.

It has nearly unlimited potential as it can be added to almost any legacy material for improved performance.

Graphene is light, strong, and has astounding electrical conducting power.

It has caught the interest of some of the world’s most deep-pocketed companies.

IBM revealed it is researching graphene as a placement material. It says it could be used for next-generation solar panels, microchips, and quantum devices.

Intel has started looking into how the staggering electrical properties of graphene can be harnessed to speed future electronic devices.

Toyota has actively applied graphene to its cars battery systems to develop faster-charging batteries.

It’s not just “new economy” applications though.

Graphene has potential uses being explored by some of the world’s largest companies that make the modern world work.

For example, Tata Steel, one of the ten largest steel companies in the world, has said it is exploring graphene coating applications to reduce corrosion.

And chemical giant BASF has been researching graphene for over a decade for electronics and to increase efficiency of lighting and reduce energy consumption.

Scomi Energy is an oil and gas service company in Malaysia. It has started developing lubricants with graphene for drill bits. The goal is to give these essential and expensive parts a long lifespan.

Again, graphene is a superior material in almost every way over alternatives.

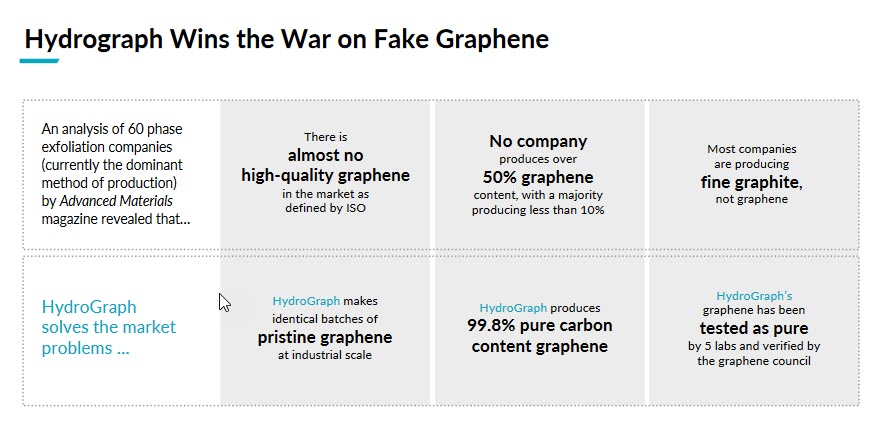

BUT full market acceptance and widespread use has been significantly hindered by the lack commercial scale volumes consistently high-quality graphene.

The here is thanks to the production innovations developed by HydroGraph, graphene has reached the point where it can be mass produced consistently and economically enough to be broadly adopted.

That was the key point for aluminum.

A massive leap in efficient, quality, and scalable production was the driving force behind the growth of aluminum.

It was the same forces behind the decades of growth of lithium-ion batteries too.

Because when quality is consistent and high, costs are getting increasingly competitive, and the material’s inherent attributes make it a better alternative, that’s when growth soars.

And this is where HydroGraph (CAN:HG / US:HGCPF) fits in.

Scaling Up: How HydroGraph Could Be A Graphene Superstar

HydroGraph is graphene focused on producing high-quality graphene with scalable production.

It’s quite a big goal.

But HydroGraph is already achieving it.

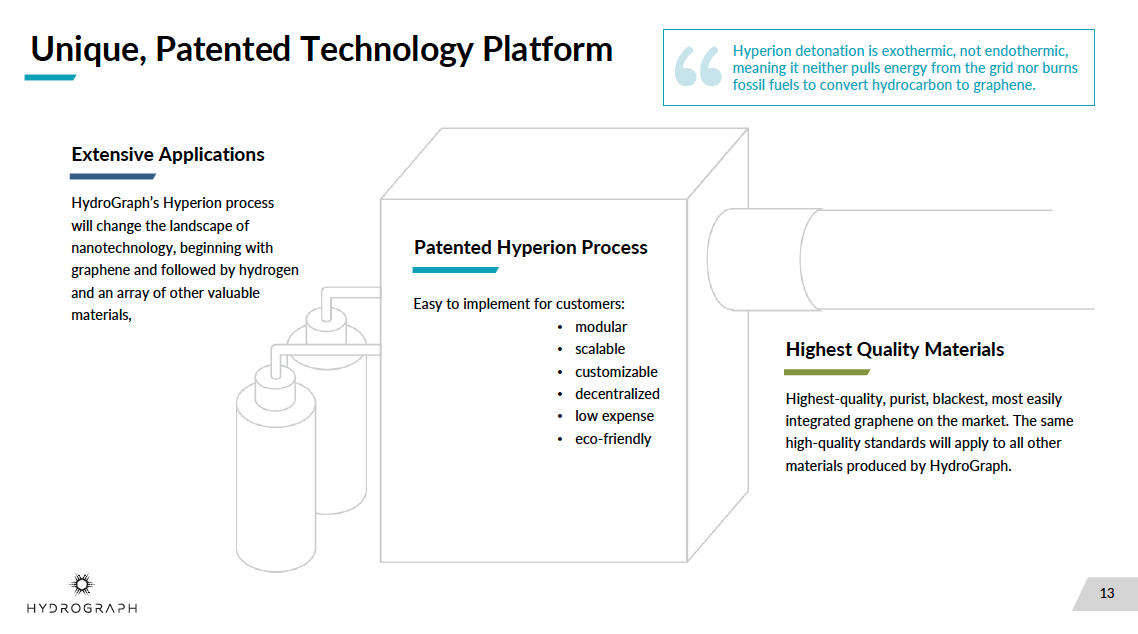

The foundation is HydroGraph’s proprietary Hyperion System.

The Hyperion System is a “detonation system” that turns common industrial gases – acetylene and oxygen – into graphene.

The gases are pumped into high-temperature chamber.

A spark is set off.

The energy release reaches a temperature of 3000% degrees Fahrenheit (a little over half the sun’s temperature).

What’s left is some of the highest-quality graphene with 99.8% carbon which is essential to high-value end users.

There’s no carbon dioxide waste or other pollutants.

This process is much different than traditional graphene production processes which involve mining graphite and processing it.

Instead, the Hyperion System produces ultra-high-quality graphene with greatest consistency and cost efficiency than other traditional producers.

The process was discovered at Kansas State University.

Hydrograph acquired the exclusive and patented rights to this process.

It’s a highly clean process compared to more industrialized production methods which use graphite flakes that are mined from the ground.

Kansas State University has produced a video explaining the Hyperion production process.

It’s quite a discovery because it solves a major problem for graphene production.

The American Scientist magazine states, “It may be easy to isolate little flakes of this one-atom-thick carbon material, but it’s surprisingly difficult to produce large sheets for commercial use”

Advantages Of HydroGraph’s “Detonated” Graphene

“HydroGraph’s Hyperion System will change the landscape of nanotechnology, beginning with graphene and followed by hydrogen and an array of other valuable materials”

- HydroGraph

As mentioned above, the key to HydroGraph’s Hyperion graphene production process is its cost to value advantages.

HydroGraph makes high quality graphene in one of the most cost-effective ways ever recorded.

HydroGraph states its system produces: Consistent highest-quality, purest, blackest, most easily integrated graphene on the market.

HydroGraph’s investor presentation breaks down how it’s graphene compares to that produced by some competitors:

These are the core advantages of the graphene produced through Hydrograph’s Hyperion System.

HydroGraph makes cost efficient graphene and can do it anywhere it wants.

HydroGraph’s Hyperion production system uses modular production facilities so they can design them for the end user requirements.

Whether it’s size, production volume, or capital, HydroGraph’s modular design allows it to meet the specific demands of many potential customers.

Those are big advantages at a time when graphene is starting to take off.

Graphene’s “Killer App”

Let’s be real.

Graphene has been heavily hyped since its discovery years ago.

It has been a “wonder material” for a long time.

But that could change soon because graphene is standing at a true turning point like the lithium-ion batteries and aluminum you know all about.

And it’s a well-worn path to success early-stage investors have seen many times before.

Here’s a chart from the Graphene Council which really breaks the “hype cycle” down so you can see the point graphene has reached:

It’s the same cycle that every new technology has gone through.

Computers. Smart phones. Social media. Or, in the example used above, aluminum.

The initial excitement was years ago.

But the industry was actively looking for applications.

There are several of them and success in a handful of them could cause the graphene market to explode.

IBM, Intel, Toyota, Tata Steel, and other major global corporations have publicly announced research ventures into developing graphene applications.

There are a many of products that could be greatly enhanced by the introduction of graphene into products.

Take industrial lubricants.

These lubricants are used in all sorts of equipment from construction equipment hydraulic systems to conveyor belts that are essential to modern food factories. Almost everything mechanical that moves requires lubricants.

The lubricants are essential to reducing friction, binding, and wear and critical that they DO NOT BREAK DOWN

It is a huge market too. Fortune Business Insights pegs the global industrial lubricant market at $85 billion.

Factories and equipment could have thousands of hours added to their lifespan with improved industrial lubricants.

That means less down time, less capital expenditure, and more production.

It’s a win/win/win that could really change the dynamics and profitability of these companies.

But that’s just one example.

Another potential graphene application is batteries.

Graphene based batteries offer so many potential advantages over current lithium-ion technology they are a serious contender to be the ultimate battery.

They are superior in almost every way.

Graphene enhanced batteries have much more capacity than standard lithium-ion batteries.

On a per kilogram basis, graphene batteries can store 1,000 watt-hours (Wh) per kilogram compared to 180 Wh for lithium-ion batteries.

That means graphene batteries would allow cars to drive six times farther, phones to last six times longer, and laptops to last six times longer.

Graphene enhanced batteries are faster charging.

In late 2021 Digitaltrends.com declared, “Fast-charging graphene batteries are hitting shelves.”

They detail how an early mover in battery packs has achieved enormous success.

They claim their mobile battery 10,000 megawatt-hour battery packs (enough to charge a regular iPhone twice) can be charged in 30 minutes.

On top of that, the battery can be cycled through 2500 times which is five times more than the average battery pack.

Those are the key aspects of batteries – durability, recharging time, and capacity – and graphene batteries top standard lithium-ion batteries on all three.

But again, that’s just batteries.

There are so many more applications for graphene.

There’s rubber. Stronger, longer-lasting tires.

Semiconductors. Faster and less heat production.

Cement. Imagine what lighter and stronger cement would do for the construction industry.

Aerospace. Lighter is always better. Lighter and stronger is what graphene does.

Electricity distribution. Less copper and more graphene.

Carbon fiber. Adding graphene to the popular weight-saving material can make it stronger and more flexible.

There are so many great applications for graphene that just a couple of these applications reaching the mainstream would cause the demand for graphene to explode.

After the long hype cycle, the materials sector is closer than ever to applications.

Vantage Market Research estimates it could be a $2.5B industry by 2028 at a 19.5% CAGR.

That’s the kind of growth rate only achieved by the fastest-growing companies and industries in the world.

HydroGraph (CAN:HG / US:HGCPF) is targeting this massive growth trajectory for graphene.

Early Stage: The Making Of A Graphene Giant

HydroGraph has targeted the massive growth of the graphene industry as a starting point for building an advanced materials company with environmentally friendly and highly efficient production of graphene and hydrogen.

HydroGraph has detailed a growth plan to tackle these massive market opportunities.

The company has spent the last few years developing the Hyperion System and identifying market opportunities.

In the last few months these efforts have jumped into a higher gear as HydroGraph hit a number of milestones.

First off, HydroGraph became an official “Verified Graphene Producer” according to the Graphene Council.

This is a significant marker of HydroGraph’s ability to use the Hyperion System to achieve high-quality graphene consistently that stood up to the inspections and requirements of the world’s leading graphene body.

It also puts HydroGraph in the top tier of graphene companies in the world.

To date only four graphene companies have been able to create the quality and consistency of graphene production required to earn this designation.

HydroGraph is set to emerge as a leader in graphene production too.

The company has announced it’s first commercial-scale Hyperion Cell graphene plan will go into operation by the end of 2022, producing up to 10 tons per year of 99.8% pure graphene to start.

This will make Hydrograph one of the largest producers of 99.8%+ pure graphene on the planet.

HydroGraph announced it attracted a C$4.2 million investment from its investors, $700,000 of it from management and the university science team that founded the science.

This is a high sign of confidence in the HydroGraph market opportunity for its products in an otherwise extremely tough market for venture-stage companies.

Finally, HydroGraph just announced the build out of its first commercial-scale production facility.

The company announced it completed building out a 13,000 square foot production facility in Manhattan, Kansas that will increase capacity to 60 tons per year.

From there the sky is the limit.

HydroGraph has the patented process, industrial management experience, and high-quality and consistent product that can be produced in production facilities anywhere Hydrograph or its customers want them.

Top 10 Reasons To Consider HydroGraph Today:

1. Breakthrough Graphene Production – HydroGraph’s Hyperion System is proven to produce consistent, cost efficient, high-quality graphene.

2. Ultra-High Purity Graphene – HydroGraph has proven capability to produce 99.8% pure graphene.

3. Consistent Quality – Not only high-quality graphene, but consistently high-quality graphene.

Customers know what they are getting down to a hundredth of a percent.

4. Scalable Tech – HydroGraph’s graphene production can be expanded rapidly by adding additional process reactors to meet growing demand.

5. Extreme Versatility -HydroGraph’s graphene can be nano-engineered for the end-client, enabling it to be integrated into current products.

6. Environmentally Sound – HydroGraph’s Hyperion Process produces the purest, blackest graphene with virtually no emissions.

7. Best in Class Management Team – Hydrograph’s management team has decades of experience in manufacturing and commercialization of industrial processes. Along with an active R&D team they are leaders in new technologies.

8. Multi-Year Growth – New materials can grow for decades or centuries. It’s been 150 years since aluminum went mainstream and the industry is as strong as ever. Lithium is on the same path. Graphene has that potential and it’s just getting started.

9. Graphene’s “Tipping Point” Real-World Applications – It’s been nearly two decades since graphene was initially discovered. Some of world’s largest companies in highly competitive industries are rolling out new graphene-based products.

10. Direct Play On Graphene – HydroGraph is not a graphite miner, graphene battery tech developer, or any other company in a graphene-related business. It’s a graphene production company and sits at the heart of the potentially explosive growth ahead for the graphene applications and industry.

Conclusion

The graphene industry is on the verge of a major growth trajectory and HydroGraph intends to ride the growth all the way to the top.

After more than a decade of hype and hope the groundwork was quietly being laid for leaps and bounds of growth.

Development takes time.

But eventually a material goes from nifty research project to commercial scale global force.

According to the industry forecasts, that time is now for graphene.

HydroGraph (CAN:HG / US:HGCPF) has been building right along with it in preparation for graphene’s turning point.

HydroGraph has the patent-protected system to produce a wonder material at a commercial scale – today

It makes the highest quality, at the best cost to value, with a very low environmental footprint…

And does it all out of “virtually thin air” with readily available industrial gasses.

The company is facing a big opportunity and has laid out a plan to develop its technological edge into becoming a potential graphene producing powerhouse.

If you see the revolutionary potential of graphene…

Or understand growth potential of superior products over time…

HydroGraph (CAN:HG / US:HGCPF) is a company you should research extremely closely.

The company is in position to develop into a major industry that’s still in the early stages.

Early movers could be in position for years of growth ahead.

You can learn more about graphene, the sector’s many exciting developments and HydroGraph’s goals at HydroGraph’s web site: www.hydrograph.com.

—-----------------------------------------notes and links—---------------------------------------------

Aluminum history - NPR - https://www.npr.org/2019/12/05/785099705/aluminums-strange-journey-from-precious-metal-to-beer-can

Supertransistors - https://nanografi.com/blog/60-uses-of-graphene-the-ultimate-guide-to-graphenes-potential-applications-in-2019/

Electronic data storage - capacity almost a million times greater than what we use today. - https://nanografi.com/blog/60-uses-of-graphene-the-ultimate-guide-to-graphenes-potential-applications-in-2019/

Elastic Metal

https://docs.google.com/document/d/1XnddlNbgA8YSdku88YETAb-sNxk-N6aJgVE6T8DZSKA/edit

K State Hydrograph

https://www.k-state.edu/media/newsreleases/2022-03/graphene-hydrogen-research-leads-to-hydrograph.html

IBM - https://www.ibm.com/blogs/research/2018/10/graphene-nanomaterials/

Allied Market Research - https://www.alliedmarketresearch.com/press-release/graphene-market.html

InvestingNews - https://investingnews.com/daily/tech-investing/nanoscience-investing/graphene-investing/graphene-cost/

American Scientist quote: https://www.americanscientist.org/article/mass-producing-graphene

Grandview Research - $94 million

https://www.grandviewresearch.com/industry-analysis/graphene-industry

Fortune Business Insights - https://www.fortunebusinessinsights.com/industrial-lubricants-market-106570

Fortune Business Insights - 40% annual growth - https://www.globenewswire.com/news-release/2022/09/08/2512542/0/en/Graphene-Market-to-Reach-CAGR-of-39-8-by-2028-Global-Graphene-Industry-Growth-Trends-Leaders-Size-Forecast-Report.html#:~:text=08%2C%202022%20(GLOBE%20NEWSWIRE),39.8%25%20during%20the%20forecast%20period.

Graphene Batteries 6X More Dense - https://jameshartchorley.co.uk/lithium-ion-batteries/

Digital Trends on graphene batteries - https://www.digitaltrends.com/mobile/fast-charging-graphene-batteries-are-finally-here/

Graphene Market Size/Growth:

19.5% CAGR – 2021 to 2028

$2.5 billion - https://www.vantagemarketresearch.com/industry-report/graphene-market-1189

Lithium Battery history:

1976 – Exxon began manufacturing the first rechargeable lithium battery, but it was beset by safety problems.

1980 – John Goodenough developed a lithium-cobalt-oxygen battery, the precursor to today’s lithium-ion technology.

1991 – Sony and Asahi Kasei released the first commercial lithium-ion battery.

1994 – Motorola introduced lithium-ion batteries for its MicroTAC cellular phones.

https://www.naval-technology.com/comment/lithium-ion-lib-timeline/

Lithium Ion - $1 trillion - https://www.prnewswire.com/news-releases/global-1-trillion-lithium-ion-batteries-market-outlook-2026-300993571.html

What is Graphene image – Source - Source: https://www.visualcapitalist.com/sp/graphene-the-wonder-material-of-the-future/

Wonder Material image – https://www.visualcapitalist.com/sp/graphene-the-wonder-material-of-the-future/

Visual Capitalist : https://www.visualcapitalist.com/company_spotlight/hydrograph/

Since a typical carbon atom has a diameter of about 0.33 nanometers,

3:20

there are about 3 million layers of graphene in a 1 mm thick sheet of graphite!

For example, its high electron mobility is 100 times faster than silicon;

it conducts heat two times better than diamond; its electrical conductivity is 13 times better

than copper; it absorbs only 2.3 percent of reflecting light.

Also, its high surface area of 2,630 square meters per gram means that

with less than 3 grams, you could cover an entire soccer field.

https://youtu.be/iEzgNh50-1w