New Markets are opening up. Technology is accelerating. It’s changing everything.

And creating fortunes in the process.

Dynamic Wealth Research exposes the biggest and most profitable changes for our readers.

Fed Conundrum:

How Higher Rates Lead To Higher Inflation

Inflation is going to be more stubborn than most investors expect.

The reason?

The Federal Reserve’s rate hikes are going to exacerbate and extend inflation.

It sounds a bit crazy.

After all, rate hikers are the cited savior of the 1970s inflationary spiral.

But that wasn’t the only variable.

There’s a far more important factor to taming inflation and it’s actively hurt by higher rates.

And once you understand this, you can be prepared for when most pundits and the Federal Reserve are confounded by “stubborn” inflation the way they were in the 1970s.

More Money, More Problems

Let’s start off with the definition of inflation.

When there is an increase of money supply without an increase of goods and services (a.k.a. production), prices go up.

Let’s use Tide detergent as an example of this.

If there is $10 in all the world and there is only one bottle of Tide, the price would be $10.

If the money supply is doubled to $20, but the supply of Tide stays the same at one bottle, it would be worth $20.

If the money supply doubles from the original to $20, but production of Tide increases and there are now two bottles, they will be $10 each.

The last example is when monetary inflation was offset by supply increases.

We’ll concede the real life world has near limitless products, alternatives, and so many consumer choices.

But this is the fundamental point.

If money supply is increased without concurrent increase in supply, prices will go up.

That’s what has happened aggressively over the last few years.

Here’s why.

It Takes Two To Inflate

For decades we’ve had “inflation.”

It was well hidden though.

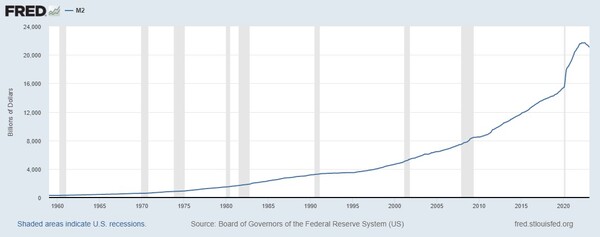

Look at this chart of M2 Money Supply:

This was inflation, but not many really noticed it because the prices stayed the same.

The reason?

Productivity has soared.

The increase in production of energy, food, etc. has kept a lid on prices.

That all changed in 2020.

The money supply (specifically M2 Money Supply) increased from $15.4 trillion to $21.7 trillion - a total increase of 41%.

Production, however, was curtailed dramatically.

And if you look at many industries, production still hasn’t come back.

Autos are the perfect example. Annual U.S. auto production is 15 million per year, well below the annual pre-pandemic average of 18 million.

That’s a big reason auto prices are stubbornly high.

And it’s not going to get sorted out anytime soon because of the Federal Reserve’s high rate policies.

Whipping Inflation (And Production) Now

The Fed is set on the path of high interest rates.

Their theory is that higher interest rates will reduce money supply and, therefore, inflation will slow down to normal.

That’s partially true.

Higher interest rates will reduce money supply. And it has been slowly ticking down for a while.

The total M2 Money Supply has fallen from $21.7 trillion down to $21 trillion.

However, we’re a long way from that $15 to $16 trillion range where all this started.

So without production increases to offset the increase in money supply, there’s still more than 36% more money out there than there was before the pandemic.

And without 36% more production, prices are going up.

That’s where the Fed comes in again.

Acquiring and deploying capital is more expensive than it has been in years because of the Fed rate hikes.

Less factories, homes, and other capital will be accumulated and deployed because of higher rates.

In other words, there will not be any major increases in production to offset the inflation.

The Fed is choosing to only address money supply and that’s going to get ugly.

Predicting The Predictable

The result of the Fed’s policies will lead to a decline in money supply, but it will also keep a lid on increasing production.

This has only been tried once before in the United States.

“From the fall of 1930 through the winter of 1933, the money supply fell by nearly 30 percent,” according to the Federal Reserve’s own history site.

We all know what followed from there.

Invest accordingly.