- Psychedelic stocks are objectively cheap, but “cheap” only appeals to investors if there is a strong value proposition behind it

- Public companies in the psychedelics space are currently generating value – in leaps and bounds

Value opportunities.

Investors already in this space may be sick of hearing this refrain, through most of 2021. But it doesn’t make the observation any less valid. And with (still) not enough investors having done their due diligence on the commercial opportunities here, it’s important to continue banging the drum.

Overall, psychedelic stocks have been moving sideways-to-lower in 2021. But, overall, the industry

continues to build out rapidly, in terms of drug development, clinics expansion, and related IP.

In other words, the disconnect between the

price of psychedelic stocks and the

value of psychedelic stocks continues to grow.

Full-speed ahead for the psychedelic drug industry

Want to see a snapshot of this rapid growth?

- Compass Pathways (US:CMPS) announces receiving its 4th U.S. patent for psychedelics

- Field Trip Health (US:FTRP / CAN:FTRP) announces three new clinics in its expanding North American network of mental health clinics

- Small Pharma Inc (CAN:DMT / US:DMTTF) announces enrolling the first patients in its Phase IIa clinical trial of a DMT-based therapy for Major Depressive Disorder

- Cybin Inc (US:CYBN / CAN:CYBN) reports the completion of its 74th pre-clinical study

Were these the monthly highlights for the psychedelic drug industry? No, this was just one particularly busy

day: October 19th.

The psychedelic drug industry has been piling up milestones and advances on a regular basis, throughout 2021, despite the weak market conditions for these stocks.

Most of these psychedelic drug companies have the luxury of being able to largely ignore current market conditions – and push forward with their business models – because these companies are very well-capitalized.

As Psychedelic Stock Watch regularly points out, institutional investors have been

lining up to invest in this industry. Collectively, the companies that are currently public have raised well in excess of $1 billion – just in the 18 months since the first of these companies started going public.

The collective burn-rate of the industry is presently only a small fraction of that amount. Translation:

most of these companies are already capitalized for several more years of development at their present (impressive) rate of growth.

Why should this matter to investors not already in this space?

A well-capitalized industry with collective market caps of ~$6 billion are currently chasing grossly underserved treatment markets with a commercial value of $330 billion.

Still not convinced of the opportunity? Try these numbers.

Two billion treatable (but generally untreated) mental health disorders, leading to

8 million preventable deaths per year. The

Mental Health Crisis.

It’s a “crisis” because conventional mental health therapies have been

grossly inadequate. Psychedelic medicine is literally the only answer. The

future for treatment markets that are worth $330 billion.

And that future isn’t too far away. While much of the research being done by these public companies is at a pre-clinical stage, there is already a considerable body of advanced clinical research – ongoing trials at a Phase II or even Phase III level of development.

Big opportunity, bigger value

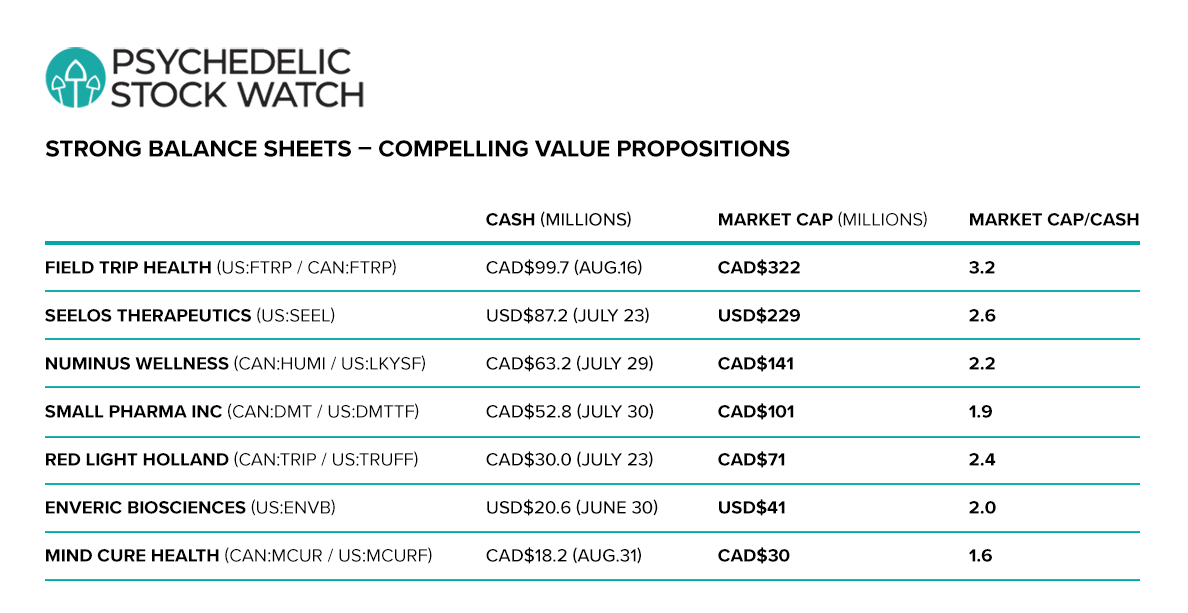

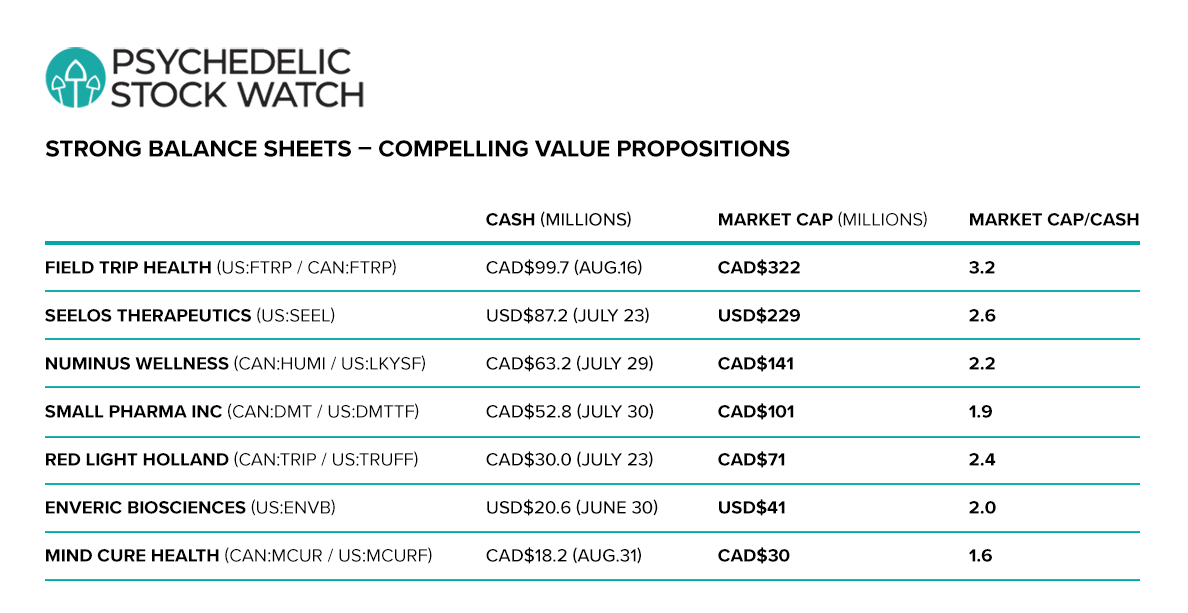

Recently, Psychedelic Stock Watch took another look at the “cheapness” factor with these stocks, focusing on just

a balance sheet-based analysis.

Given the size of the opportunity, given the financial strength/stability of these companies, the multiples above are ridiculous. They are valuations that one might expect for an industry reporting a stream of bad news – or no news at all.

Not the sort of valuations that investors expect to see with busy companies, reporting good news, with

the greatest growth potential of any investment opportunity in life sciences today. But that’s just a look at the companies that are exceedingly cheap on a pure liquidity basis.

Not mentioned in that previous article were companies that are already generating substantial revenue streams. While Field Trip builds out its own clinics network, a few much smaller psychedelics companies are already generating even more-robust revenue streams.

Novamind Inc (CAN:NM / US:NVMDF) and

Levitee Labs (CAN:LVT US:LVTTF) are both already generating millions in revenue per quarter, but both sit with

market caps of USD$30 million or less.

These revenue streams are from early-stage operations using only

ketamine-based therapies – the only psychedelic drug already broadly legal. As drug reform moves (slowly) forward and these next-generation psychedelic drugs begin to emerge from the clinical trials pipeline, revenue potential will expand by additional multiples.

With (globally) 2 billion treatable mental health disorders to target, the growth potential is virtually unlimited.

Cheap stocks with unlimited growth potential and lots of cash. Those sorts of opportunities don’t come around every day in markets.

Clearly, some investors are still struggling with anti-drug biases, or they would have already jumped at such an opportunity.

That hasn’t stopped some of the most high-powered investors from both

Silicon Valley and Wall Street from jumping on the psychedelics bandwagon. That’s how these people got to be “high-powered investors”: recognizing opportunity.

Recent signs of life with psychedelic stocks

Collectively, psychedelic stocks have suffered through a down year to date in 2021. Individually, however, there have been signs of stronger stock performance, particularly in recent weeks.

- Cybin moved from a short-term low of $1.83 (on August 19th) to $2.80 by August 31st. More than 50% in less than 2 weeks. That followed an even longer and larger run for the company earlier this in the summer.

- After hitting an all-time low of CAD$0.59 on September 22nd, Novamind jumped by over 60% in less than two weeks – before seeing some profit-taking over the past week.

- Field Trip is currently more than 30% higher than its all-time low of $4.23 on September 20th.

- Small Pharma is currently nearly 30% off its all-time low of CAD$0.27 on October 15th.

- Compass Pathways is currently 19% above its 2021 low on October 6th.

With Compass expecting to report the much-anticipated results from its Phase IIb clinical trial for Treatment Resistant Depression by year end, the company may just be starting to build momentum.

For reasons noted above, the robust news flow from these stocks isn’t going to taper off. The need for these next-generation therapies can only continue to grow.

Drug development will continue to accelerate.

Clinic expansions will continue to accelerate.

Revenue streams will continue to accelerate.

Given the cheap valuations for many of these companies, it’s also not unreasonable to expect a flurry of M&A activity. In short, catalysts for higher valuations for these stocks will continue to be numerous and significant.

As the Mental Health Crisis continues to rapidly worsen and psychedelic drug companies continue to rapidly advance operations on all fronts, current compressed valuations for psychedelic stocks should not be expected to last.

Indeed, we may currently be seeing

sentiment shifting for these stocks in advance of an (overdue) run for the sector.

DISCLOSURE: The writer holds shares in Cybin Inc, Numinus Wellness, Mindcure Health, Novamind Inc, Levitee Labs and Small Pharma Inc.