The psychedelic drug industry has already been a spectacular growth story in life sciences.

How is this industry growing? Where do we start?

An emerging industry is a lot like a new crop. Even if carefully nurtured, the crop can fail for a number of reasons (from adverse weather to simply planting the wrong seeds).

When the psychedelic drug industry was first launched, many serious investors were skeptical – especially given the difficulties in launching the legal cannabis industry. What were the prospects for building an entire industry atop (currently) illegal drugs that are significantly more powerful than cannabis?

In fact, with public companies in this industry little more than a year old, we have seen spectacular growth in this emerging industry. Not just in one or two facets, but in literally every direction.

- Growth in investing base

- Growth in R&D

- Growth of an industry

- Growth in capital

- Growth of a message

Growth in the investing base of psychedelic stocks

Not surprisingly, millennial investors are well represented among holders of psychedelic stocks. These younger investors are known for being early entrants in new investing trends – particularly those that are tech-related.

What

is surprising is the support that the psychedelic drug industry has received from older, more conservative investors.

It’s not just Silicon Valley mavericks like

Peter Thiel. Canada’s Kevin O’Leary is a conservative investor best-known as a host on ABC’s startup show,

Shark Tank (as well as Canada’s

Dragon’s Den).

O’Leary was outspoken in his refusal to go anywhere near cannabis stocks. He’s been just as emphatic about his

support for the psychedelic drug industry. He’s an early and enthusiastic investor in Canadian-based

MindMed Inc (US:MNMD / CAN:MMED).

Wall Street fund-manager Jim O’Shaughnessy just celebrated his 61st birthday. And he just Tweeted his own enthusiasm about the

"amazing" potential of the psychedelic drug industry.

What is the attraction that is luring in investors of all stripes and ages? It’s

the science, and the huge opportunity that can be derived from this science.

Prior to the criminal Prohibition of psychedelic drugs, early research had already shown that many of these substances had tremendous potential to treat mental health disorders.

As the research climate for these substances has thawed, there has been an explosion in new research. Clinical results have been very impressive. Driving this research is an enormous crisis – and a huge investing opportunity.

The

Mental Health Crisis is

a pandemic of stress-related mental health disorders. Thanks to the additional stresses created by COVID-19 lockdowns, this Crisis is spiraling out of control. Already,

as many as 1 in 4 people globally suffer from stress-related disorders like depression, anxiety, addiction and PTSD.

Worse still, existing treatment options for these conditions are mediocre, at best. Huge treatment markets are desperately in need of new drugs – psychedelic drugs.

That is the opportunity that brought together such a diverse collection of investors. But it’s merely the starting point for this industry.

Growth in psychedelic drug R&D

As scientists commenced this

Renaissance in psychedelic drug research, two factors were immediately apparent.

- These are very potent substances.

- They have unique medicinal/psychoactive properties that provide a radically different form of drug therapy.

That understanding sparked

more research. With this industry still in its infancy, R&D is rapidly expanding into numerous other fields of medical research.

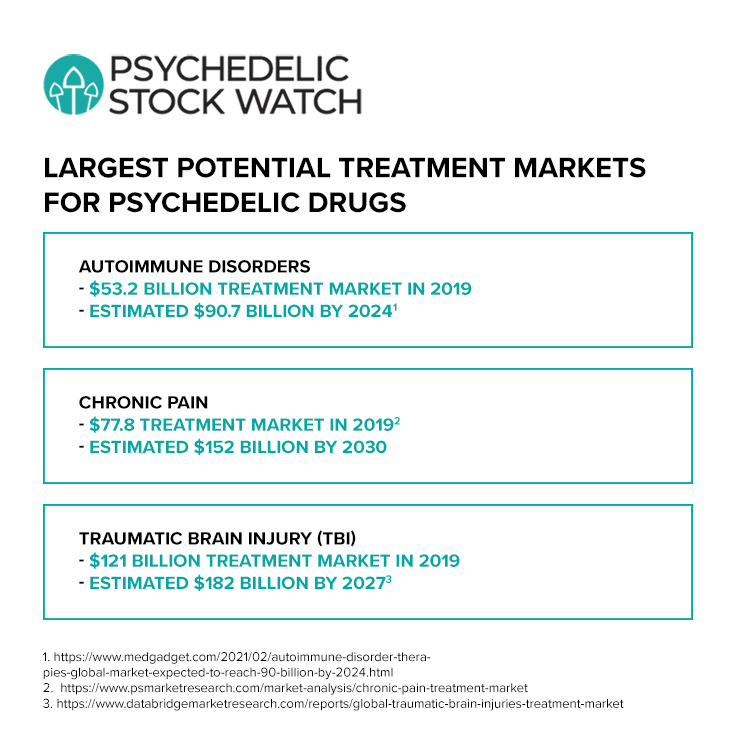

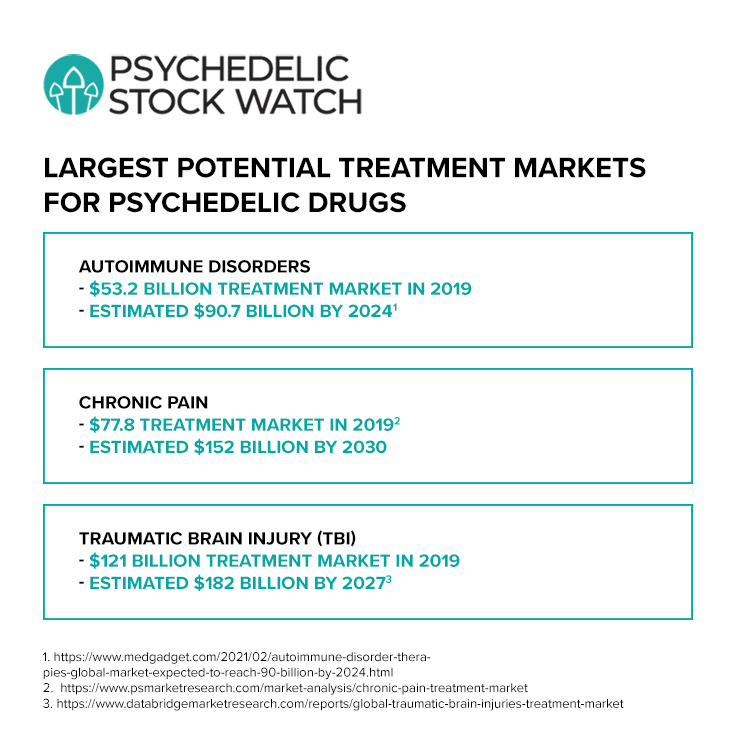

We’re not talking about fringe disorders and small treatment markets here. Research is targeting many (most?) of the major healthcare treatment markets: TBI, cognitive decline, chronic pain, and even autoimmune disorders.

All gigantic treatment markets. The Traumatic Brain Injury (TBI) market alone is already roughly a $120 billion treatment market, expected to grow to $182 billion by 2027.

Meanwhile, earlier R&D targeting the Mental Health Crisis continues to advance.

The Multidisciplinary Association for Psychedelic Studies (MAPS) is reporting spectacular results for its Phase III clinical trial for MDMA-based therapy for PTSD.

Compass Pathways’ (US:CMPS) Phase IIb clinical trial for treatment-resistant depression is expected to report results by year end.

Several other public and private players in this industry have lead R&D initiatives that have commenced or are about to commence Phase II clinical studies.

Growth of the psychedelic drug industry

The psychedelic drug industry is much more than a one-trick pony. It’s not focused solely on mental health related drug R&D. It’s not even limited to drug research alone.

Most psychedelics-based therapies are

guided therapy sessions, as patients process an “experiential” dosage of the psychedelic substance (psychoactive, and often hallucinogenic).

Given the unique treatment parameters, many early players in this industry, both public and private, chose to partially or exclusively target the treatment side of this industry: mental health clinics.

With ketamine a legal drug and psilocybin now being approved (on a limited basis) for legal therapy, these clinics are already in operation and producing revenues. As drug development advances and the regulation of these drugs moves into the 21st century, this treatment market will expand exponentially.

Driving both drug R&D and mental health services is yet more tech.

Next-generation software platforms are incorporating (among other things) AI. This is being engineered into

digital therapeutics platforms for mental health treatment and into bioinformatics platforms for drug R&D.

These psychedelic drug companies are not just on the cutting edge of drug R&D. They are also at the forefront in pioneering other medical technologies.

This also includes drug delivery systems. Sublingual drug delivery and intranasal delivery are just two of the systems that can advance not just psychedelics-based treatments but all healthcare.

This is still a small industry in terms of market capitalization. But it already has a big footprint in healthcare.

Growth in capitalization

How can one small industry (where the total market capitalization of all public companies is little more than $3 billion) possibly be pursuing so much drug development, infrastructure development, and tech development -- simultaneously?

It’s simple. These may be small companies. But they carry a big (financial) stick.

The Compass Pathways IPO in September 2020 did more than just launch an explosive rally among psychedelic stocks last fall. It also

opened the floodgates for more investment capital.

Since the Compass IPO,

over $700 million has been pumped into this industry – roughly evenly balanced between public and private companies.

It could have been much more.

Almost all of these financings have been oversubscribed. And public companies have put the brakes on new financings over the past three months.

With share prices depressed, they don’t want to dilute their stock. With virtually all of these companies cashed-up, they have the luxury of not needing to go back to capital markets until they can raise capital on more attractive terms.

In short, there appears to be an almost unlimited pool of institutional capital ready and willing to back this industry.

Growth in the “message” of psychedelic drugs

With so much in the industry’s favor, why have psychedelic drug stocks been mired in a trough for much of 2021?

Answering that question begins by looking at the NASDAQ. With valuations (especially for the large-cap tech stocks) at unprecedented extremes, tech has generally underperformed this year – dragged down by a correction in better-known (and overvalued) companies.

Psychedelic stocks have been caught in that wake.

Making these stocks more vulnerable to selling pressures is simply the newness of the industry. As noted, public companies have only been around for about a year.

Then there is nature of the industry itself: psychedelic drugs. Decades of anti-drug propaganda (and phobias)

to unlearn.

New science. New treatments. New tech. New thinking.

That is

a lot for investors to absorb as they wrap their heads around this extremely exciting opportunity. What can speed up the curve in informing potential investors about this science, treatments and technology? Education.

Enter the mainstream media.

Media Coverage Of Psychedelic Drugs Soars

…In less than a month since then [mid-April], no less than

17 feature articles on psychedelic drugs have appeared on mainstream media sites – better than one every second day.

That level of exposure (most of it very favorable) will capture the attention of a lot of people. Not just investors, but also the politicians and regulators who need to get on board for these drugs to be normalized for medicinal use.

The big opportunity in psychedelic drug stocks

Hundreds of billions of dollars are (potentially) on the table in

drug development. Hundreds of billions of dollars are (potentially) on the table in

mental health services.

More billions can be derived from the supplementary IP being developed in support of this industry.

As noted, at present the combined market caps of the public companies in this space is only a little over $3 billion. And roughly two-thirds of that total is represented by Compass Pathways and MindMed alone.

As these public companies grow into this opportunity, investors have the opportunity to climb aboard for the ride.

Psychedelic drug companies have a big footprint in healthcare, with the potential to develop a huge footprint in the not-too-distant future. Psychedelic drug stocks have a small price – still a ground-floor opportunity for new investors.

As this industry continues to grow in every direction, even more Silicon Valley billionaires and Wall Street investment icons can be expected to jump on the bandwagon. Many smaller retail investors will also like their odds.

DISCLOSURE: The writer holds shares in MindMed Inc.