- Jerome Powell says the Federal Reserve intends to start raising interest rates in two years

- History says that Fed-heads never keep their word on interest rates

Federal Reserve Chairs are facing increasing (and well-deserved) criticism – from an audience that used to pathetically fawn over their every word and gesture.

But let’s give credit where credit is due. Recent Fed Chairs exhibit at least one human virtue: consistency.

They consistently pump markets and create asset bubbles.

They consistently (and egregiously) exacerbate wealth inequality.

And they consistently

talk about reigning in their radically extreme, totally unprecedented and utterly reckless monetary policies much, much more than they actually deliver on their words.

The Boys (and Girl) who cry “wolf”, over and over and over and over.

Fool me once, shame on you. Fool me twice, shame on me.

In Aesop’s fable, the innocent dupes who were originally fooled by the false warnings of a nearby wolf quickly caught on to the con being perpetrated on them.

In the real world, however, market dupes continue to heed the empty words of Fed-heads, month after month, year after year.

When former Federal Reserve Chairman B.S. Bernanke initiated the Era of Insanity in Western monetary policy at the end of 2008, he did so with a solemn promise. He would immediately “normalize” interest rates (and money-printing) once the crisis of the 2008 Financial Crisis had passed.

Supposedly, the crisis passed quickly. According to popular mythology, the U.S. economy began an improbable and unprecedented “recovery”: 10+ years of uninterrupted growth.

What happened to U.S. interest rates (and Bernanke’s promise)?

Still at 0% in 2009.

Still at 0% in 2010.

Still at 0% in 2011.

Still at 0% in 2012.

Still at 0% in 2013.

Of course, over those 5 years, B.S. Bernanke

talked about “raising interest rates”. He talked almost every day. He cried “rate hike” over and over and over. But never delivered.

In fact, Bernanke and his succeeding Wolf-Girl, Janet Yellen, never even managed to raise rates to the lower boundary of “normalcy” (3 – 5%)

over a span of 10 years. That was despite these serial liars repeatedly boasting about all the “growth” and “jobs” in the U.S. economy – for which they claimed sole credit.

A new crisis, the same game

Now we’ve had the next financial crisis. Yet again, a crisis that was/is directly built upon the Fed’s previous, reckless monetary policies.

For those who weren’t paying attention at the time, the Fed began its latest “emergency operations” several months

before the world had ever heard of COVID-19. It pounded the repo market with roughly $4 trillion of new “support”.

Then the real crisis of COVID-19 began (Western governments embarking upon economically suicidal lockdowns). Trillions more in emergency operations from the Fed’s monetary psychopath.

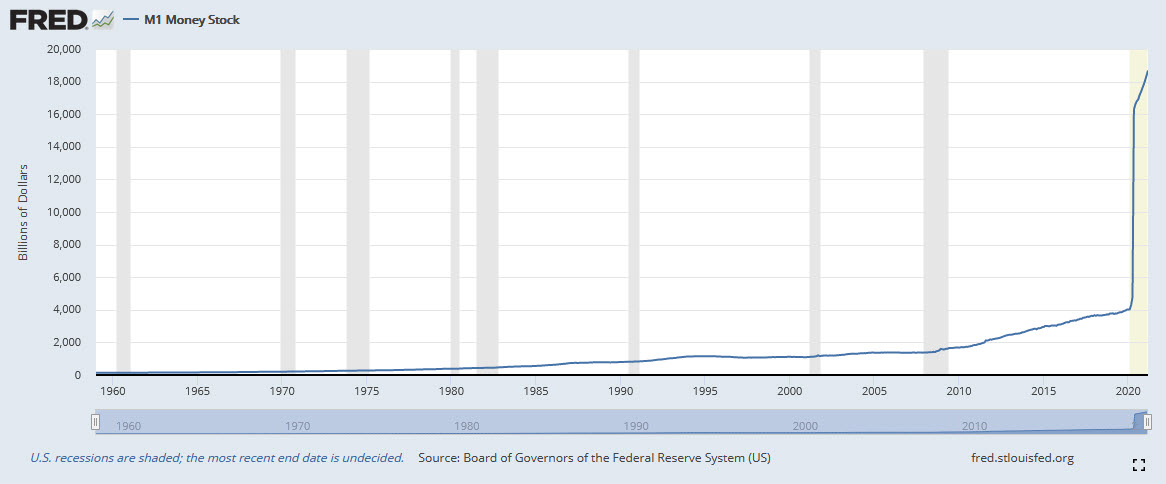

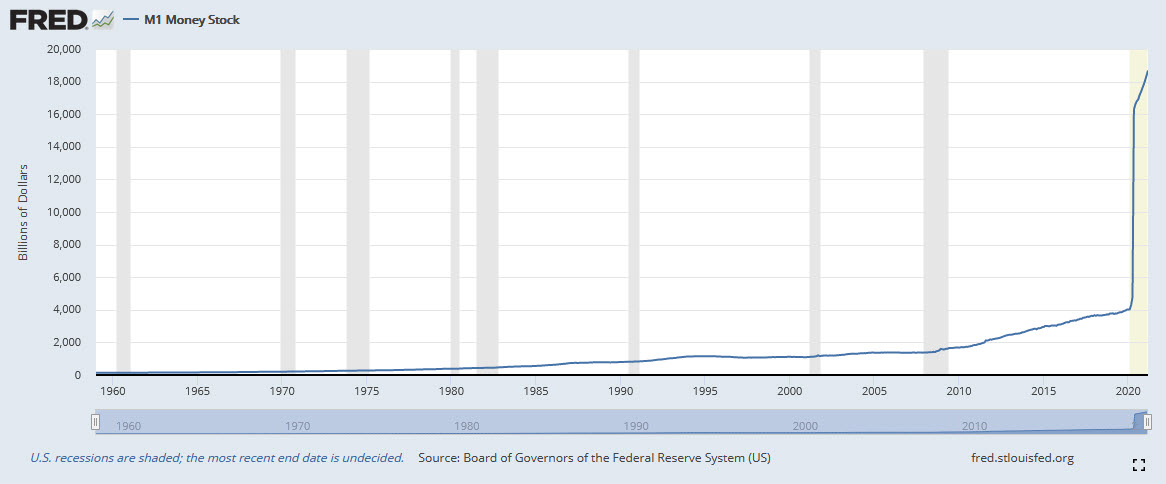

Dynamic Wealth Research has illustrated this insanity, and illustrated how much more insane/extreme have been the policies of Jerome Powell.

B.S. Bernanke engaged (above) in the

first hyperinflationary expansion of the U.S. monetary base from 2009 - 2013: the infamous Bernanke Helicopter-Drop. The characterization of Bernanke’s monetary extremism is beyond debate.

We can see what “responsible monetary policy” looks like:

a horizontal flat line. For decade after decade. Decades of

prosperity.

We can see the (at first) gradual departure from responsible monetary policy in the early 1970s, after the United States defaulted on its gold obligations and ended the last vestige of a gold standard.

Then we get Bernanke’s straight near-vertical line. Hyperinflation.

Now observe the scale of Jerome Powell’s madness.

It’s so much more extreme than Bernanke’s own extremism, that (along with vigorous “massaging” of this chart) the Bernanke Helicopter-Drop has become invisible.

The Bernanke

mountain of new money-printing now looks like the proverbial mole-hill – next to the Powell Pump that has followed it. And try to spot (in the heavily doctored chat above) the years of “tapering” about which both Bernanke and Yellen have boasted.

Serial liars. Monetary psychopaths.

Powell cries “rate hike” (lol)

Today, we got the latest serialized installment of the real-life version of

The Boy Who Cried Wolf. Jerome Powell is “forecasting” that the Federal Reserve will start raising interest rates, a mere two years from now.

Not merely implausible. It’s impossible.

Because while Bernanke/Yellen/Powell have been inflating the U.S. money supply to infinity, the U.S. government is simultaneously inflating its debt-bubble to infinity.

“Raising interest rates” would mean that the U.S. government would have to start making

real interest payments on all those trillions of debt, not merely the

nominal interest being paid with U.S. interest rates frozen at zero.

Beyond that, any real rise in U.S. interest rates would:

- Collapse the massively over-extended leverage in U.S. equity markets.

- Collapse the massively over-extended U.S. housing market.

- Collapse the massively over-extended $1.5 quadrillion derivatives bubble.

Raising U.S. interest rates is not merely implausible, but impossible. Unless Jerome Powell wants to

deliberately rupture all these Fed-created bubbles. Ridiculous.

Who could believe such ridiculous talk, from the latest in a cast of serial liars? Apparently, almost everyone. At least, that’s what we are supposed to believe.

The Big Banks used their algorithms to immediately push U.S. markets lower – on the “fear” of these very distant (and totally imaginary) rate hikes.

Gold was slammed by the Big Banks even before Powell’s empty words. Apparently, gold could sense that Powell was about to threaten it with “rate hikes”.

Leaving the theater and returning to the real world

Jerome Powell has unleashed (hyper)inflationary Hell upon the world. Again, this is beyond debate.

Inflation “statistics” (that every rational adult knows are absurd understatements) are all hitting multi-year or multi-decade highs.

This is no surprise, because

real economists know what causes (price) inflation: inflating the money supply and diluting the currency.

Inflation is always and everywhere a monetary phenomenon in the sense that it can be produced only by a more rapid increase in the quantity of money than output. [emphasis mine]

There is “no such thing as a free lunch”, except in the fantasy-world of the Federal Reserve (and their fork-tongued Chairman). In Fed Fantasyland, Powell and Co. can conjure infinite quantities of new U.S. dollars into existence – with no negative consequences of any kind.

Not merely a free lunch. A free all-you-can-eat, 24/7 buffet. Fed Fantasyland is a wonderful place.

Unfortunately, it doesn’t exist.

Jerome Powell’s hyperinflationary money-printing is about to reap the hyperinflationary price increases about which Friedman warned us. And there is no exit.

We’re told by the ultra-credible Jerome Powell, that he will start to exit this insanity, in a mere two years.

a) We’ve already seen what a Fed “exit” looks like (via Bernanke and Yellen). Non-existent. Just more of the same.

b) With hyperinflationary pressures already unleashed upon the U.S. economy (and the world), even in Fed Fantasyland there is no intention of doing anything to slow this hyperinflation for at least two years.

Hyperinflation (of prices) can be – and has been – virtually an overnight event historically.

What we are looking at today is the most extreme inflationary (hyperinflationary) forces being unleashed upon the United States in its near-250-year history.

And Jerome Powell is openly telling us that he plans to be nothing more than a deer in the headlights with respect to this inflation/hyperinflation for at least two more years.

And the Federal Reserves has neither the intentions nor the capacity to “fight” this inflation. Not today. Not two years from today.

Not until after the U.S. dollar has been removed from circulation and not until after the U.S. government has formally defaulted on its massive-and-unrepayable debts.

Reality is a bitch.

That’s why Fed-heads have scrupulously avoided it for over 10 years.

The hyperinflation tidal wave on the horizon

The tidal wave of hyperinflation in the United States (and most of the Western world) is now visible on the horizon. Look again at the charts above if this has still not sunk in.

Dilute a currency and it loses value. Dilute a currency

infinitely and it goes to zero. We have 1,000 years of unequivocal monetary history that proves that point.

As we see in the charts above, the U.S. dollar is being infinitely diluted – at a near-vertical rate. Price hyperinflation is coming sooner, not later.

Stop standing on the beach staring at the wave (like a Fed chairman).

Move to “higher ground” ASAP: physical gold (and silver).

Fool me once, shame on you. Fool me twice, shame on me.

Get fooled three times and you will be

annihilated by hyperinflation.