- Paper assets – like U.S. dollars and U.S. Treasuries – are facing literal destruction from hyperinflation

- Real estate has ceased to be a scarce asset class (and wealth preservation vehicle) due to the radical over-construction of new housing units

- Gold has a 2,000-year track record as a perfect vehicle for wealth preservation

Dynamic Wealth Research regularly reminds investors that gold is the ultimate hedge against inflation. And we were singing this tune

loud and clear long before recent “inflation fears” have now (finally) bubbled to the surface.

Gold’s unique capacity to shield against inflation is not theoretical. It is a historical fact, and one that can be unequivocally illustrated in multiple ways.

How gold is a perfect shield against inflation

Residential real estate in Manhattan is considered to be some of the most “expensive” real estate on the planet. Priced in ever-depreciating U.S. dollars,

Manhattan real estate prices have increased by ~10,000% over the last 100 years.

But priced in gold, Manhattan real estate is only 25% more expensive. In other words, over a span of 100 years, Manhattan real estate has only gotten 25% more valuable (an ROI of 0.25% per year versus holding gold).

All the rest of this rise in prices has been

inflation: the paper dollar losing value. And gold has provided perfect protection against that U.S. dollar inflation.

Is 100 years not enough of a demonstration? We can do better.

Two thousand years ago, in ancient Rome, a gentleman of that era could purchase the finest suit of clothing with a 1-oz gold coin: a custom-made toga, along with a leather belt and sandals.

Four hundred years ago, a gentleman of that era could also purchase the finest suit of clothing with a 1-oz gold coin: a tailored suit and accessories.

Today, with a 1-oz gold coin, a gentleman can still purchase a fine suit and accessories with a 1-oz gold coin. But because the price of gold has been

heavily suppressed in recent years, you would (temporarily) have to buy off the rack.

That’s

two thousand years of protection against inflation.

In contrast, the U.S. dollar has lost 99% of its value in 100 years. And many pseudo-analysts and charlatan economists have labeled the depreciating dollar a Safe Haven.

In reality, the Mighty Dollar has never been anything more than a leaky bucket for wealth. And today that bucket has a large hole in it.

Why gold is a perfect shield against inflation

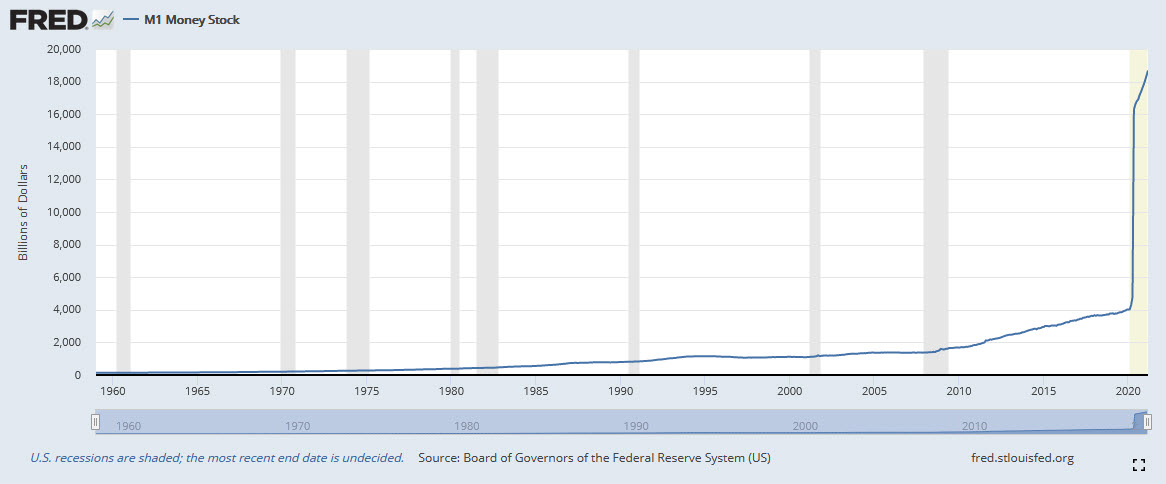

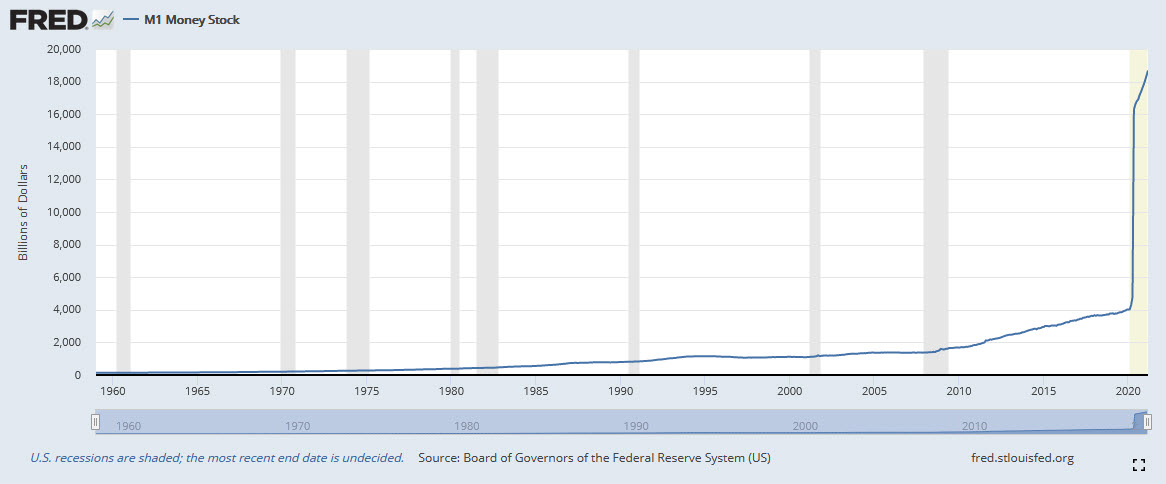

Dynamic Wealth Research has

partially explained why gold is the ultimate hedge against inflation. The U.S. dollar is being rapidly and radically diluted (at an unprecedented rate) while the supply of gold is virtually flat.

You dilute a stock and it loses value. You dilute a currency and it loses value.

It’s not a difficult concept to grasp, unless you happen to be a central banker or an economist. To these “experts”, the concept of dilution is unfathomable.

But gold is not a perfect shield against inflation simply because its supply is flat.

Gold is also scarce. And it has substantial intrinsic value.

Gold is prized greatly for its aesthetic qualities, in jewelry, art and other decorative (and religious) functions. It also has valuable metallurgical qualities. But because it is valued so highly for other purposes, it’s rarely cheap enough to be used industrially.

Because gold is scarce

and valuable, it is “precious”. Hence the label: precious metal.

The fact that gold is precious makes it a Store of Value. You put your wealth into gold, but – unlike a U.S. dollar –

gold doesn’t leak. Whatever wealth you store in gold is preserved, forever.

This has always been true. That’s why (priced in U.S. dollars) gold has increased from $35 per ounce to over $2,000 per ounce in the last 50 years.

That’s why (priced in gold) the price of Manhattan real estate has barely changed in 100 years.

Why you need gold NOW

The difference today is that not only is the U.S. dollar being diluted (and losing value) faster than ever before, its actual

existence is now directly threatened.

Hyperinflation.

Hyperinflation is the death of a currency. The literal destruction of all wealth denominated in that currency. In the article above, we explain why the coming U.S hyperinflation will not and cannot be “transitory”.

Game over.

Game over for the dollar itself.

Game over for U.S. Treasuries and all other bonds denominated in U.S. dollars.

The pseudo-analysts and charlatan economists also refer to U.S. Treasuries as a Safe Haven asset class.

Yes, the debts of a hopelessly insolvent debtor, denominated in a dying currency. What could possibly be “safer” than that?

How about a

real Safe Haven asset with a 2,000-year track record for perfect wealth preservation? Gold.

Again, the pseudo-analysts and charlatan economists would have investors believe that you have other choices. What about real estate, or even cryptocurrencies?

Don’t listen to these false prophets.

With real estate now having an effectively infinite supply, it has ceased to be a Safe Haven.

Having no intrinsic value, cryptocurrencies could never become a Safe Haven.

Even those cryptocurrencies that maintain (artificial) scarcity have no intrinsic value. And scarcity alone cannot protect wealth – as we’ve seen by the recent overnight 30 -40% crashes in some of these digital gambling tokens.

Meanwhile, by (rapidly and aggressively) building upward,

the supply of real estate units is now effectively infinite. At a time that real estate

prices are at (by far) their highest level in history,

real estate has lost its #1 basis for value: scarcity.

Worse still, many real estate markets are already radically over-supplied.

And crazy speculators are currently bidding above asking prices in many markets.

What happens in a market with near-infinite supply, that is radically over-supplied, and also over-priced by more than at any other time in history?

It crashes.

Maybe not tomorrow, but the crash in Western real estate markets is inevitable. And its severity will be historically unprecedented.

Robbed of scarcity, real estate becomes an asset class with

virtually no bottom.

Simultaneously, the COVID-19 pandemic has knocked the bottom out from under much (most?) commercial real estate. A Day of Reckoning in that market is still to come.

Let’s review the asset classes that are considered “safest” today by the majority of market analysts, economists, and serious investors.

This isn’t rocket science.

The U.S. dollar has been

destroyed by the Federal Reserve. Its track record is unequivocal. Tied to the U.S. dollar, the fate of U.S. Treasuries is carved in stone.

Real estate has likewise been totally undercut as a vehicle for wealth preservation.

Cryptocurrencies are digital gambling tokens whose value has been driven radically upward by an investor mania that (in many ways) resembles the Tulip Mania in the 1600s. Manias never end well.

Then there is gold – and silver. Silver remains a precious metal to the vast majority of humanity. Only the unenlightened West regards it as “an industrial metal”.

With global silver stockpiles exhausted (due to decades of radical under-pricing), silver is headed for a supply crunch that is unprecedented in the history of commodities.

However, with the artificially induced volatility in the global silver market, it doesn’t function quite as well as gold as a wealth preservation vehicle.

Paper, land, or metal?

We could always rule out paper assets as true “safe havens” (for all of the reasons above).

Now, for the first time in history, the supply of real estate has been rendered effectively infinite. Today, real estate is not a wealth preservation vehicle. Rather, it is an enormously unstable wealth

trap.

At a time when we have literally never been more in need of a Safe Haven to shield our wealth (from banker-created inflation), there is only precious metals.

With the supply of gold and (especially) silver

extremely finite, you can’t afford to delay a move into metal. Gold and silver cannot shield your wealth from the ravages of hyperinflation when

the vaults are empty.