New Markets are opening up. Technology is accelerating. It’s changing everything.

And creating fortunes in the process.

Dynamic Wealth Research exposes the biggest and most profitable changes for our readers.

The Real Housing Crisis

Anyone watching legacy media is nervously awaiting a housing crash.

They’ve been informed of the perfect storm coming for housing prices.

First, the housing market overheated in the post-pandemic bubble.

Second, interest rates have soared. The interest rate on the 30-year mortgage has jumped from 3% to about 6.8%.

Third, the despondent economy and mass layoffs are pushing potential buyers to wait-and-see sidelines.

So many macro factors are headwinds for housing, yet these charts tell a much different story that is likely to play out.

In Pictures: The Housing Market Dichotomy

These two charts from Redfin, a popular real estate news source, really illustrate the current housing market.

The first one shows pending home sales:

It’s a sharp drop.

Pending home sales are down more than 30% from their bubbly highs.

Despite the downturn though, the rate is still around the levels in 2017, which was hardly a housing collapse.

So yes, the market is down, but it’s not a disaster.

It’s definitely right-sizing a bit though.

But that’s the volume.

Most people are focused on prices and expecting it to get worse before it gets better.

Again, the expectations don’t match true reality on the ground and here’s a chart to prove it.

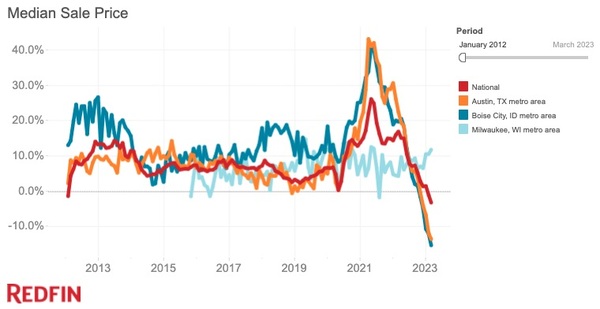

This chart shows the national media price and the median prices in a few markets:

The chart shows a sharp difference depending on locality in the direction

The national market is starting to dip.

Red hot markets including Boise, Idaho and Austin, Texas are dropping fast. But they’re coming off unsustainable jumps of 40%.

Milwaukee, Wisconsin, however, is slow and steady. It never soared during the boom and it’s still on the rise now.

All this shows the real estate market is correcting. Hot markets have gone cold and average markets are still average.

It’s all perfectly normal.

The problem is the perception.

Because the fear of a housing sector meltdown is going to exacerbate the real housing crisis that’s building.

The Dip Before The Rip

The real housing crisis is going to be a lack of housing.

Many of the top tier residential real estate investors have estimated a shortage of between four and six million units.

But financial problems in banks and housing market fears are slowing construction.

Bloomberg reports, “At current activity levels the US homebuilding industry is completing 200,000 more homes annually than it’s starting.”

So the industry is going to be producing less housing when it’s already behind.

For investors who can look out about two years, an exceptionally strong opportunity is opening up.

Fear has taken over the market, but, in time, the fundamentals will show through.

And housing, whether through direct investment or residential REITs, should offer solid returns from any dips in the market.