New Markets are opening up. Technology is accelerating. It’s changing everything.

And creating fortunes in the process.

Dynamic Wealth Research exposes the biggest and most profitable changes for our readers.

This 30-Year Low Signals Potential Bottom In Tech

Before a new bull market can begin, the craziness from the last one must be wiped away.

That’s what’s happening according to the historic low we’re going to review today.

Consider this.

In a raging bull market all kinds of crazy things happen.

The Special-Purpose Acquisition Company (SPAC) bubble is Exhibit A.

Two EV companies which went public via SPACs, Nikola Motors (NKLA) and Lucid Group (LCID), were shooting stars.

They’ve both collapsed. Nikkola shares have cratered from $66 to $2. Shares of Lucid haven’t done much better. They’re down $53 to less than $7.

Virgin Galactic (SPCE), despite no clear achievable plan to generate revenue, was another SPAC star.

It has fallen from a peak of $54 at the height of SPAC mania to around $4 today.

Sure, all of these companies had big potential.

But they were years away from being worth anywhere close to the tens of billions of dollars of valuations they had received after going public.

This is the craziness that needed to be wiped away. And it has.

Which brings us to today’s multi-decade low in Initial Public Offerings (IPO).

When stocks are raging and investors are chasing risky assets, IPO’s soar.

When the greed has turned to fear, IPO activity dries up.

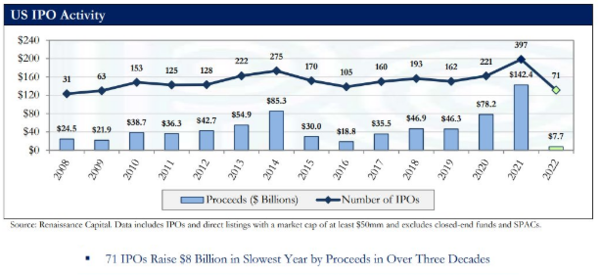

Well, when we were reviewing 10 Predictions For 2023 from the Irrelevant Investor, this one chart really stood out to us.

The chart shows the near complete collapse of IPO activity in 2022:

The amount of money raised in IPOs in 2022 is so small you can barely see it.

This is the exact opposite of the record-setting IPO activity in 2021.

More importantly, it’s a sign of a tech sector that’s been fully revalued to the point it’s actually worth buying in again.

After all, if you want to know the state of the tech sector – which is the driving force of most IPOs because the companies are searching for capital to grow – look at IPOs.

As we saw in 2008 and 2009, the sharp drop in IPO activity was a sign that tech company valuations had returned to reasonable levels.

Odds are there are some gems in the tech sector now too.