Sponsored Content

$12 Trillion Industry Steams Toward

More Record-Smashing Highs In 20241

***Why this company could ride the mega-growth wave all the way to the top.***

The food and agriculture sector is on fire.

And if you’ve been watching the food and ag sector stocks set new all-time highs over the last year, you’re going to want to see this now.

Because high food prices have sent revenues and earnings soaring across the sector.

Bloomberg recently reported:

“Agriculture stocks are beating their global peers this quarter as extreme weather, the war in Ukraine and rising protectionism drive up food prices.”2

And there’s still more room to grow.

The USDA’s latest “Food Price Outlook” warns food prices could jump as much as 7.9% in 2024.

The bonanza for food and agriculture could keep going for a long time.

But what you’re going to see below is about a unique and urgent situation forming within the industry.

It’s about a small, yet fast-growing sector that has largely missed out on the great food and ag Sector boom of the last couple of years.

But now, due to a series of global events combined with years of underinvestment, it could soar exponentially beyond the rest of the food and ag sector.

Industry insiders are seeing the massive potential, in the $12 trillion dollar U.S. ag Sector

For example, Agri-Pulse, a major agriculture industry publication, is predicting “boom years” ahead for it.3

Today you’ll see how it’s all shaping up and you’ll learn how one upstart company has spent years working to position itself and make sure it’s at the center of it all.

It's all included below -- including the name of the companies at the heart of all this.

So let’s start at the beginning on the "front lines" of who has been making a fortune from all this.

High Food Prices Supercharge Agriculture Stocks

High food prices have crushed many consumers.

But the high prices are making fortunes for investors.

Time magazine recently broke down what’s happening in, “How Food Companies' Massive Profits Are Making Your Groceries More Expensive.”4

The article showed how net earnings are soaring for food companies.

Kraft-Heinz earnings are up 448%.

Cal-Maine Foods are up 718%.

And Conagra is getting practically “left behind” with earnings growth of 56%.

But it’s not just the top of the food chain here.

The revenues and earnings boom has flowed all the way down to the other end of the food and ag sector.

Look at Deere & Co.

Its earnings have exploded right along with food prices.

Back in 2019 the farming equipment giant earned just over $10 per share.

Last year it booked earnings of $33 per share.

That’s a gain of 230% in earnings and Deere’s stock has followed right on behind.

Farmland is another example.

The average value of an acre U.S. farmland has increased more in the past two years than it has in the nine years before that.5

High food prices are making fortunes for investors across the entire sector.

But there’s a situation that could send one essential agricultural commodity soaring and potentially deliver gains bigger than them all.

Dark Secret Propels Modern Agriculture To Record Highs

One of the greatest opportunities right now across the food and agriculture industry is in fertilizer.

The two charts below show why fertilizers are an essential part of modern agriculture.

The first chart shows how crop production has soared while total farmland has remained largely stagnant6:

The second chart shows the correlation between the huge rise in crop yields above and the equally large rise in fertilizer use7:

That’s modern farming right there - more fertilizer, more yield.

And it’s becoming both a problem and a potential opportunity.

Fertilizer Facing "Silent Crisis"

The fertilizer industry is becoming more strained than ever.15

One of the best examples of the upheaval in the fertilizer industry is potash (pronounced "pot" and "ash").

The New York Times has identified potash as an “obscure but crucial” commodity.9

Potash is truly crucial.

And we’ve got a picture from the University of Florida to demonstrate the impact of potash fertilizer on corn13.

Here’s corn with different amounts of potash fertilization13:

LEFT: Healthy Corn with fertilizer made with Potash. RIGHT: Corn fertilizer made with Potash.

Potassium provides an essential source of potash for farmers needing their crops to flourish,making sure they get the right nutrients for optimal growth. The impact is striking.

Potassium provides an essential source of potash for farmers needing their crops to flourish,making sure they get the right nutrients for optimal growth. The impact is striking.

The big corn on the left has had ample potash fertilizer applied during their growth.

The small ones on the right were officially defined as “potassium deficient.”

Corn is just one example of the essential power of potash.

Potash is used for carrots, peas, beans, and an endless variety of fruits and grains.

But the future of large and reliable supply of potash is more at risk than it ever has been since modern agriculture began in the 1950s.

Potash's “Silent Crisis” Builds

Potash is facing some big problems.

The deeper-reaching financial media have seen the potash situation building.

Bloomberg has warned of a “…Global potash deficit.”10

The scientific community sees it too.

The Union of Concerned Scientists has recently warned of a “shortage” of potash.17

But it could be even worse than that.

Because the potash deficit is causing a time of great upheaval in the global potash market.

And it has opened up a potential massive opportunity for companies like American Potash (CSE:KCL / OTC:APCOF) that are just entering their major growth phases of development.

Potash alone is a $26 billion market.11

But for such a sizable industry, it’s concentrated in very few hands.

The reason is because large scale potash deposits are relatively rare.

There are only a handful of countries with active, industrial scale potash deposits.

Potash production is so concentrated that only two small regions produce 70% of the world’s potash.

The first is in Canada.12

The Saskatchewan basins are the most potash rich regions in the world.

The large potash mines here are the driving force behind Canada accounting for 31.8% of all the world’s potash production.

The other major potash production regions is where things get concerning for the agriculture industry.

That’s because the other major potash production region is in the border areas between Russia, Belarus, and Ukraine.

This is home to the most fertile soil in the world.

And it’s also home to 38.8% (18% Belarus and 20.8% from Russia!) of the world’s potash production.8

For obvious reasons, this major source of potash may not be available9.

And that’s exactly what happened in early 2022.

When Russia and Belarus were cut off from international trade, the price of potash soared.

The real and ongoing scare brought a lot of attention to new sources of potash production.

And companies like American Potash (CSE:KCL / OTC:APCOF) really showed their potential as a major new source of potash.

Why Potash Is A “Critical Element”

Photo by James Baltz on Unsplash

Potash is one of the world’s most essential minerals.

Despite its limited uses – the world uses 95% of all potash in fertilizer11 – it is an essential ingredient to modern farming and keeping the world fed10.

That’s because plants use the potassium from the potash to to build deep roots which allows them to recover and intake more water.

This allows them to produce bigger fruits and survive variable weather from storms to droughts.

This seems basic, but it truly has a huge impact on the production capacity of farms.

This is why the New York Times described potash as a “critical element”9 and the global agriculture industry was concerned about potash exports from Russia and Belarus.

Because when potash supply dips or supply increases, the potash market can get crazy fast.

There’s No Bubble Like A Potash Bubble

Potash is one of the most supply and demand sensitive markets in the world.

You’ve seen directly what it does to corn production.

So the costs of not having enough potash fertilizer can easily surpass even big price gains.

We saw this twice already in the last few years.

Look at this chart from NASDAQ market data which shows the potash price over the past 20 years or so:

There were two major price spikes.

The first was between 2004 and 2008.

The price of potash soared from less than $100/tonne to more than $700/tonne.

The main driver then was demand.

Agriculture prices were soaring.

Corn, for example, went from $2.00 per bushel to more than $7.00.

The cost of not having max production was extreme.

As a result, every farmer wanted as much potash and other fertilizers at virtually any price.

That’s why there was a six-fold increase in potash prices just from a bit of demand increase.

For investors the equation was massive.

Crop prices jumped, potash prices soared, and potash stocks absolutely exploded.

It happened all over again in 2022.

In the 18 month period from March 2021 to November 2022 potash prices lept from around $200/tonne to a new all-time high of more than $800/tonne.

This time it was supply fears.

Demand wasn’t dropping, but the market was bracing for major supply disruptions from Russia and Belarus…

Which, as you saw above, account for 38% of world potash supply.

Again, it didn’t take much.

Just a slight change to supply or demand and prices can soar.

Even today there’s still lingering questions about global potash production and the price of potash remains well above historical norms at a recent report of $370 per pound.

That’s why American Potash’s (CSE:KCL / OTC:APCOF) location is critical as well. But we’ll get into the resource-rich region in a moment.

American Potash Targets World’s Next Great Potash Discovery

American Potash’s core asset is the Green River Potash And Lithium project located in southern Utah.

The location is the key here.

The Green River Basin is one of the most resource rich regions in all of North America.

The Green River is one of the western U.S.’s largest rivers and a major tributary to the Colorado River.

It runs from Wyoming, Colorado, and ends in Utah where it joins the Colorado River at Canyonlands National Park.

The Green River dates back centuries.

This river has been the life support for many nomadic tribes dating all the way back to the Fremont peoples of 2000 years ago.

That’s thousands of years of water moving and concentrating mineral-rich sediments along a riverbed.

Think of the resource-rich salt flats, but just on a potentially bigger and richer scale.

Or the Western Canada Sedimentary Basin that’s been the global lifeblood for uranium and potash.

Or the Powder River Basin for coal.

The Green River Basin has the kind of geographic history that has created the world’s largest mineral deposits.

And it has been the driving force behind a century of resource development success in the region.

It all started in the 1920s with LaBarge oil.

Then it expanded to the discovery of Green River shale formation, estimated to be 3 trillion barrels of oil shale14, the largest in the world.

For potash, the Green River Basin is also home to a company called Intrepid Potash (IPI).

Intrepid Potash is the largest producer of raw potash in the United States.

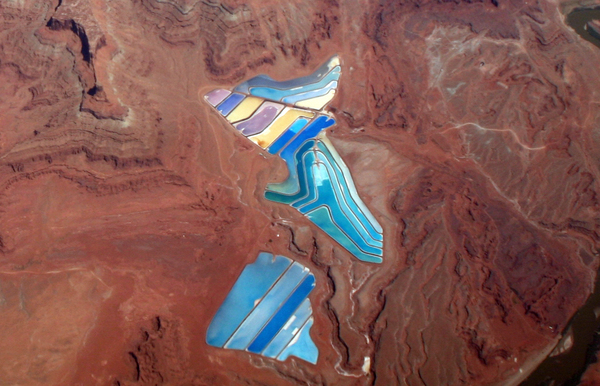

Here’s an aerial view of Intrepid Potash taking the potash-containing brine and having it dry out in long, shallow pounds in southern Utah’s dry climate:

Intrepid Potash (NYSE: IPI) in Utah.

Source: Wikipedia

It’s a big operation.

But here’s the thing.

This giant potash production operation is just about 10 miles away from where American Potash has staked potash exploration claims.

But again, back to the resources of the Green River Basin.

The large historical amount of natural resources here doesn't just mean there’s likely to be more, there’s also a lot of historical exploration data.

And this is what is giving American Potash an advantage in its quest for the next great U.S. potash discovery.

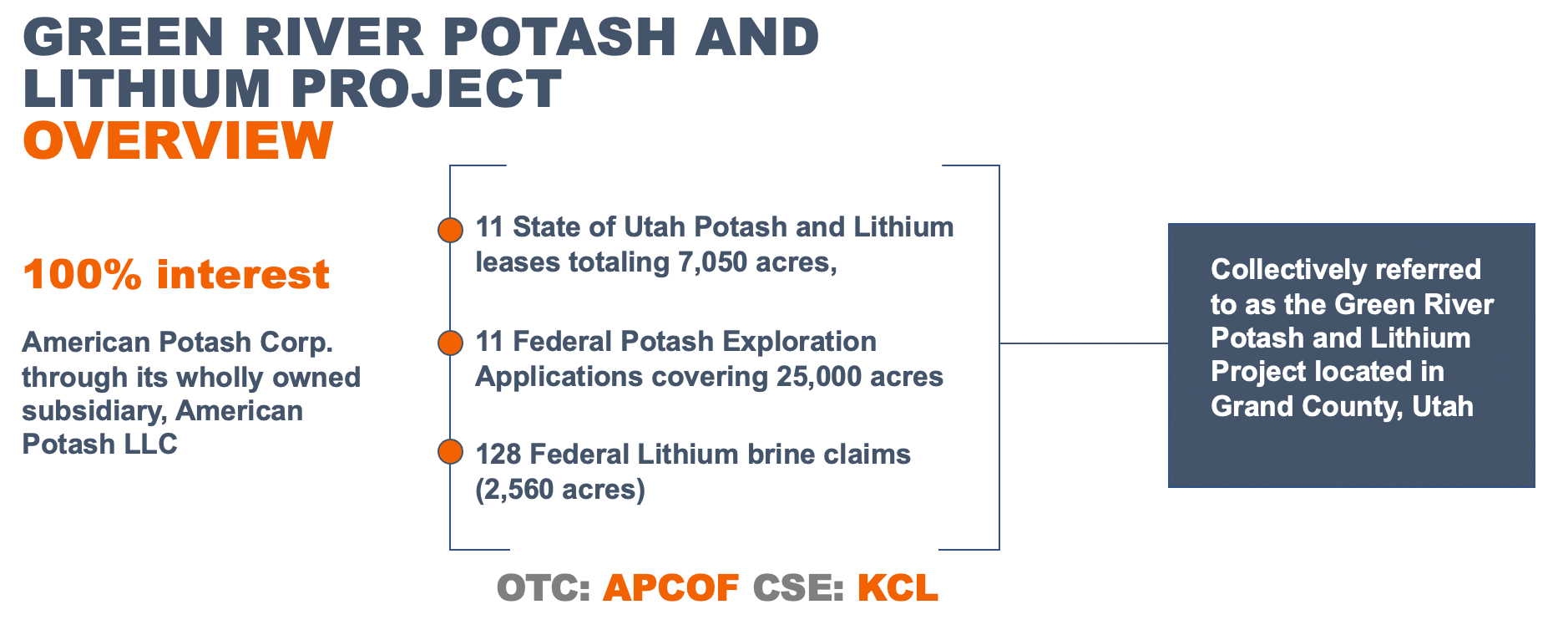

American Potash has acquired a 100% stake in mineral rights covering a huge land stake in the heart of the Green River Basin.

These leases cover 11 official leases covering 7,050 acres of land for potash and lithium resources.

There are potash specific applications for another 11 leases which would cover 25,000 acres.

And there’s still 128 more at the federal level for lithium brine which would cover more than 2,500 acres of exploration territory.

Here’s a map of where these leases and licences cover:

The Green River Project is located in Grand County, southeastern Utah, approximately 20-30 miles west of Moab, and 12 miles northwest of Intrepid Potash's mining operation.

The potash exploration and development project is just the starting point for American Potash.

The company has a lot more going for it.

Specifically, the people leading the company forward.

American Potash’s Management

The company has assembled a team of experienced mining company executives, all with major successes under their belts.

They include:

Jonathan George, BSc. Geol. President & CEO, Director - is a geologist and entrepreneur, and has been active in all aspects of mineral exploration, development and resource capital markets for over 35 years, with projects throughout the world.

He has held senior positions with numerous publicly traded resource companies over the years, most notably as the Co-Founder, President and CEO of Creston Moly Corp. where he oversaw the advancement of Mexico's largest molybdenum deposit to the Prefeasibility stage in under 2 years, resulting in a valuation at the time of $560 million. Creston merged with Mercator Minerals in a transaction valued at $178 million.

As the President and CEO of ESO Uranium Corp., Jon was instrumental in that company assembling and exploring one of the largest and most prospective land packages in the Athabasca Basin, where ultimately Alpha Minerals (ESO's successor) and Fission Energy made the rich Patterson Lake South uranium discovery.

Kenneth R. Holmes, LLB. Director - began his legal career in 1982 and spent ten years in a predominantly corporate and securities practice, but which also included a full complement of commercial, real estate, tax technology and intellectual property matters and often had international issues and elements.

This resulted in exposure to and an understanding of a broad range of businesses and transactions, including natural resources (mining, oil and gas) companies.

Since 1991, Mr. Holmes has been acting as in-house counsel and senior management of, or consulting to, companies, public and private, involved in businesses ranging from natural resource exploration, franchising, television production, and gaming.

Kent Ausburn, PhD, PGeo. Director - is a senior geologist with over 30 years of experience in the mineral exploration/mining industry, with three years experience as a consulting hydrogeologist, leading to a focus on property acquisition with equity positions in both private and public companies.

He has extensive field and management experience in the minerals business in a wide variety of mineral deposits, rock types and geologic terrains.

He has worked and managed exploration programs in several countries including the Western USA, Alaska, Mexico, Colombia, SW Mainland China and Malaysia and has also consulted for several environmental consulting companies in the highly competitive and regulatory-complex Los Angeles-Orange County areas of Southern California.

Dean Besserer, BSc, PGeo. Director - Mr. Besserer has more than two decades of mineral exploration experience working in over 50 countries, including across much of North America and often leading projects with annual exploration budgets exceeding US$20 million.

Mr. Besserer was previously Vice-President and Partner at APEX Geoscience Ltd., a consulting firm with offices in Canada, South America and Australia, with clients including BHP Billiton, De Beers, North Country Gold and Kaminak Gold.

In addition, Mr. Besserer previously served as a director of Brilliant Mining, Niblack Resources, Sentosa Mining and VP Exploration for various junior mining companies. He is a Professional Geologist and a "Qualified Person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101").

John A. Greig, MSc, PGeo. Senior Advisor - has played a key role in a number of successful exploration/development projects since 1969.

Mr. Greig was a founder of Sutton Resources Ltd. (TSX and NASDAQ), Cumberland Resources Ltd. (TSX and AMEX) and EuroZinc Mining Corp. (TSX and AMEX). He served as a director from 1979 to 1999, and senior officer from 1979 to 1996, of Sutton Resources Ltd.

He served as a director from 1979 to 2004, and Chairman from 1993 to 2004, of Cumberland Resources Ltd. He also served as a director from 1999 to 2006, and Chairman from 1999 to 2002, of EuroZinc Mining Corp. Sutton Resources owned a 100% interest in the major Bulyanhulu gold depost (now a mine) in Tanzania and was bought by Barrick Gold for $350 million in 1999. EuroZinc Mining Corp. owned 100% of the giant Nerves Corvo copper/zinc mine in Portugal and merged in 2006 with Lundin Mining Corporation.

EuroZinc’s market capitalization just prior to the merger was approximately $1.8 billion. Mr. Greig served from 1985 to 2000 as a director of Winspear Resources Ltd. (TSX-V), which owned 70% of the Snap Lake diamond deposit (now a mine) in the Northwest Territories, Canada. Winspear was taken over by DeBeers for $260 million.

Mr. Greig served from 1990 to 2005 as a director of Dynamic Oil and Gas Inc. (TSX and NASDAQ), which was sold to an income trust for approximately $105 million and from 2005 to 2006 he served as a director of Shellbridge Oil and Gas Inc. (TSX-V) which was sold to True Energy for approximately $60 million in shares of True Energy Trust.

7 Reasons To Consider American Potash Today

1. The “Silent Crisis”8 MIT Predicted Is Still Building. Potash is essential. Global farming capacity is built on fertilizer. WIthout it, crop production would plummet and prices would go up.

2. The U.S. Relies On Potash Imports. The U.S. produces just 6% of its potash production and is the #2 importer of potash in the world. America needs new domestic sources.

3. Breaking The Near-Monopoly Control Of Potash Market. The potash industry is controlled by a handful of countries and companies. Small companies like American Potash have the potential to disrupt this major and lucrative industry.

4. Proven Location. American Potash’s project is just a few miles away from the United States largest potash mining company.

5. Historical Data. The Paradox Basin is among the most resource-rich regions in the world, and the Green River Project is in the heart of it. It has been explored extensively, and there is enormous historical data to better target future exploration drilling.

6. Room To Grow: Potash Prices can DOUBLE and still be below recent highs. Where potash prices go, potash stocks are likely to follow.

7. American Potash Has Been Building Up For 2023 Breakthrough: The company has laid out a new drilling and exploration program to advance the highly prospective properties it has acquired.

Consider American Potash Today

American Potash (CSE:KCL / OTC:APCOF) sits at the center of many special situations.

Each one of these alone could make the company a potential major success.

All together though…the potential is staggering.

Let’s review.

The company’s land package is second to none.

It’s big. It’s in the heart of the prolific Green River Basin. And it’s right next to the largest U.S. potash mining company.

It’s a potash explorer. So the resources it is exploring for are essential and more in-demand than ever before.

The timing is great. Potash is coming off one of its best years ever due to world events and limited new sources of potash supply.

The current valuation is priced to grow.

Intrepid Potash has a market cap of about $300 million.

That’s 60X more than American Potash’s value as of July 2023.

And there’s the historical data. This isn’t shooting in the dark. There are decades of drilling and data for this area.

Finally, American Potash is set to start drilling soon.

Consider shares of American Potash (CSE:KCL / OTC:APCOF) today.

—--------------------------------------------Sources—-------------------------------------

(1) https://www.thebusinessresearchcompany.com/report/agriculture-global-market-report

(2) https://www.ers.usda.gov/data-products/food-price-outlook/summary-findings/

(3) https://www.agri-pulse.com/articles/18495-fertilizer-industry-looking-forward-to-boom-years-for-potash

(4) https://time.com/6269366/food-company-profits-make-groceries-expensive/

(5) https://www.nass.usda.gov/Publications/Todays_Reports/reports/land0822.pdf

(6) https://ourworldindata.org/grapher/index-of-cereal-production-yield-and-land-use

(7) https://grist.org/article/many-countries-reaching-diminishing-returns-in-fertilizer-use/

(8) https://www.nytimes.com/2022/01/30/world/europe/lithuania-belarus-potash.html

(9) NY Times - Obscure but Crucial Commodity Fuels Geopolitical Tussle in Eastern Europe - https://www.nytimes.com/2022/01/30/world/europe/lithuania-belarus-potash.html

(10) Bloomberg potash deficit quote - https://www.bloomberg.com/news/articles/2022-05-02/fertilizer-buyers-eyeing-canada-to-fill-global-potash-deficit

(11) Potash Global Market - $26 billion - https://www.statista.com/statistics/1287684/global-potash-fertilizer-market-size/

(12) Sources - production by country - https://natural-resources.canada.ca/our-natural-resources/minerals-mining/minerals-metals-facts/potash-facts/20521#L2

(13) Potash deficiency - corn - https://www.icl-group.com/blog/one-step-from-world-hunger/

(14) Green River Basin - 3 trillion barrels of oil - https://www.shawcor.com/north-america-onshore/green-river-shale

(15) MIT - Silent Crisis - https://news.mit.edu/2015/potash-silent-crisis-brews-1124

(16) Mining.com quote: https://www.mining.com/web/canadas-scrambling-to-fill-a-massive-global-fertilizer-deficit/

(17) Union of Concerned Scientists - How a Fertilizer Shortage Could Drive Food Prices Even Higher - https://blog.ucsusa.org/omanjana-goswami/fertilizer-shortage-could-drive-food-prices-higher/

(18) Western Potash Corp quote - https://www.westernpotash.com/about-potash/potash-and-the-world